The effective PAGIBIG Contribution Table 2018 will still follow the latest HDMF Circular No. However you may voluntarily increase the monthly contributions if you plan to loan higher amounts from Pag-IBIG later on.

How To Calculate Your Sss Contribution Sprout Solutions

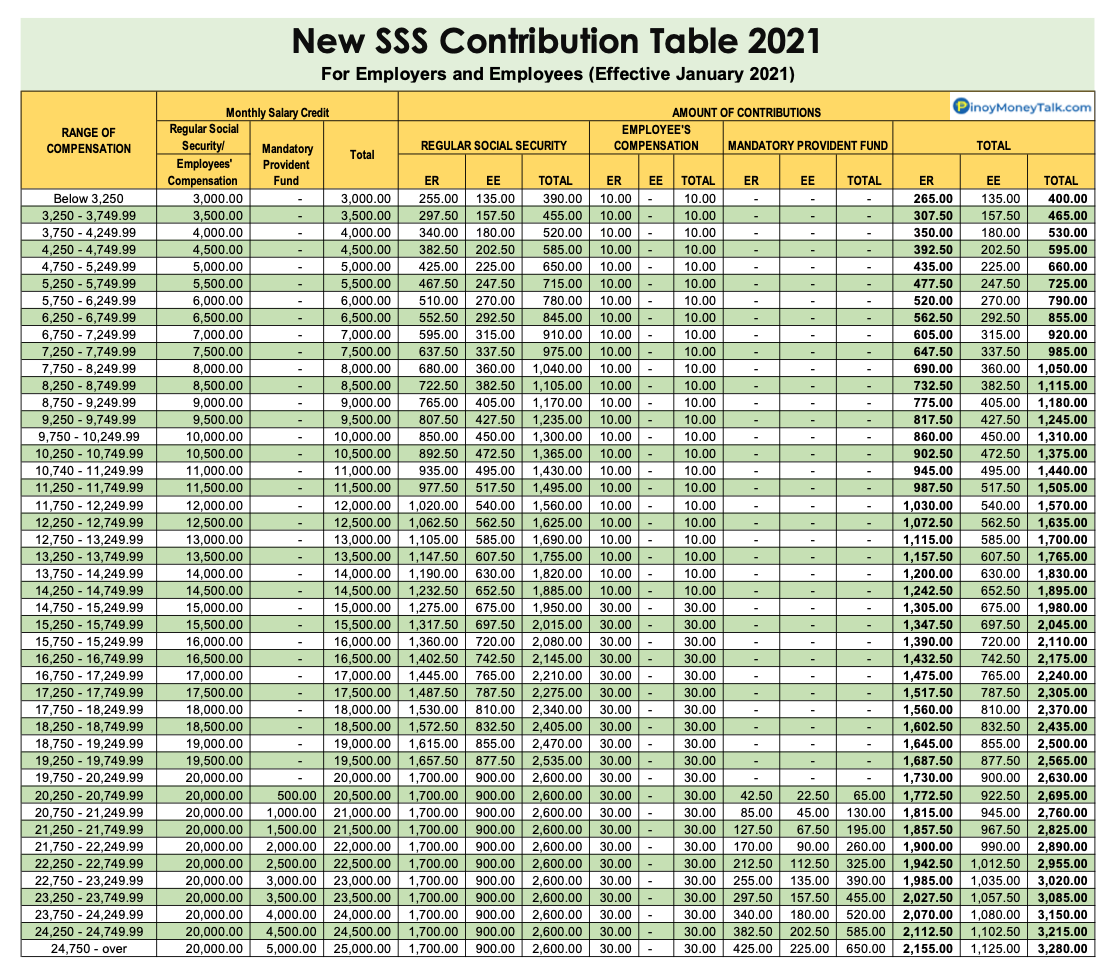

This updated table will be the reference how much will be the monthly contribution.

Pag ibig deduction table 2019. Sample computation for a worker with Php 3000 monthly basic salary. PAG IBIG MP2 2019 ACTUAL DIVIDEND EARNINGS - YouTube. With the current COVID-19 pandemic happening worldwide this calamity is already affecting the global economy and would soon manifest on our local.

In response to the directive of President Rodrigo Duterte PhilHealth will still collect premiums from Direct Contributors using the 3 percent instead of the 35 percent contributions rate. NEW PHILHEALTH CONTRIBUTION SCHEDULE. Same example with your monthly basic salary of Php15000 then your monthly contribution is Php225 by looking at the table.

Total Deductions SSS PhilHealth Pag-IBIG 112500 375 100 1600 So whats next. 212 JUNE 28 - JULY 02 2021 CEBU HOUSING HUB - SPB 66th 1st Auction - No Discount CEBU PROPERTIES. 274 commonly known as the Revised Guidelines on PAGIBIG Fund Membership PAGIBIG Contribution Table 2018 PAGIBIG Monthly Compensation Monthly Compensation shall refer to the basic salary and other.

MP2 dividends are derived from no less than 70 of Pag-IBIG Funds annual net income. Here is the Pag-ibig contribution table 2019. Monthly Pag-IBIG contribution.

P100 Regardless of how much your salary is the maximum income Pag-IBIG will consider for mandatory deductions will always be P5000. P5000 x 002 P100. And the P60000 instead of the P70000 ceiling in CY 2020.

Subtract your total deductions to your monthly salary the result will be your taxable income. 21 For Public Auction. Php 3000 x 002 Php 60.

Know about the Pag-IBIG contribution table 2019. Vist Pag-IBIG Funds Website. This involves deducting from the salary of employees along with their employers share of contribution for Pag-IBIG contribution.

274 also known as Revised Guidelines on PAGIBIG Fund Membership PAGIBIG Contribution Table 2018 Monthly Compensation shall refer to the basic salary and other allowances where basic salary includes but is not limited to fees salaries wages and similar items received in a month. Pag-IBIG Fund grants 5074 socialized home loans to low-wage earners in Q1 2021 up by 25 Pag-IBIG Fund granted socialized home loans to 5074 members from the minimum-wage and low-income sectors totaling P22 billion in the first three months of 2021 despite the continuing pandemic according to the top executives of the agency. Philhealth Contribution Table for 2019 2020 2021 2022 2023 2024 to 2025 Important Update as of 01052021 as published in PTVNewsph.

Pag-IBIG Savings I also called Provident Savings is a regular savings program for all members of the Pag-IBIG Fund or Home Development Mutual Fund HDMF. If you are planning to be a member in 2021 then basing on the Pag-IBIG contribution table 2019 or Pag-IBIG contribution table 2020 can only bring more confusion. 211 JUNE 21 - JUNE 25 2021 NCR BRANCH - SPB 177 1st Auction - no discount Batangas Bulacan Cavite Laguna Rizal and Metro Manila.

The updated 2019 PAGIBIG Contribution Table will be based on the latest HDMF Circular No. Maximum deductible amount for Pag-IBIG. How to pay for Pag-IBIG contributions.

For reference the average MP2 dividend rate in. Go to the Membership Registration Page. The employees monthly salary deduction for Pag-IBIG contribution.

Complete the Application Form. How to Get your Pag-IBIG MID Number. How to Compute PhilHealth Contribution.

For HDMF Pag-Ibig For a monthly basic salary of Php15000 then your HDMF Contributions is Php15000 X 02 Php300. Pag-IBIG Contribution Table for 2021. Your salary is already above Php 1500 so your contribution will be computed using 2 of Php 5000 or simply Php 100.

To help you land on more accurate contributions we have provided the latest contribution table below. The monthly membership contributions of barangay officials shall be deducted by their respective barangays from their monthly honoraria. If playback doesnt begin shortly try restarting your device.

To compute how much you have to pay as an employee or employer use the Pag-IBIG contribution table above and this formula. Pag-IBIG Contribution Table 2019 Pag-IBIG Fund Requirements. Updated Pag-IBIG Contribution Table OFWs employee employer and self-employed or voluntary members must take note the latest Pagibig Contribution Table for 2019 in order to be aware how much you are paying to Pagibig Fund every month.

Pag-IBIG Fund Receipt PFR. Enter your Personal Details. Pag-IBIG contribution Monthly Basic Salary x Employees or Employers Contribution Rate.

Table of Contents. So if you are earning Php 30000 per month then your Pag-ibig contribution will be Php 100. Php 3000 x 002 Php 60.

Your MP2 savings earn tax-free dividends at a rate higher than the dividend rate of the Pag-IBIG Fund Regular Savings Program. 60x 200 x 80 PHP9600. 2 Pag-IBIG Acquired Assets For Sale June 2021.

The employer counterpart shall be provided and sourced from local funds of their respective barangays.

Monthly Sss Contribution Table 2018 26 485 Likes 6 Talking About This Wallpaper Of House

Komentar