Basic Monthly Compensation regularly paid for service rendered by the employee. Unit 616 Tower One Stock Exchange.

Statement Of Financial Position 2017 2021 Balance Sheet Equity Finance

Ampalarca April 26 2017 Here is a summary of the process and requirements to register with the Social Security System SSS Philippine Health Insurance Corporation PHIC.

Sss philhealth pag ibig accounting. Accounting and taxation services for pinoy SMEs. 20th to 24th day of the month. Lucky for you you can pay your SSS and Philhealth.

A fine of PHP 5000 to PHP 10000 multiplied by the total number of employees of the company. Your contributions to Pag-IBIG PhilHealth and SSS is dependent on your budget. This means all regular and supplementary income receives by the employee.

SSS Philhealth Pag-ibig HDMF Due dates of Contributions by amaranthbiz. Most companies will already automatically deduct these from your paycheck but in some cases like if youre self-employed you have to make the payments yourself. Hello I work in a big bpo company in makati.

Like most of new employees out there I used to pay no attention to my salary deductions. But a fixed part of your monthly budget can help you to not miss one. Journal Entry SSS Premiums Payable 156000 Philhealth Premiums Payable 37500 Pag-ibig Premiums Payable 20000 Employees Compensation Payable 3000 Withholding Tax Payable 153750 Cash 370250 To record remittance of government dues.

After you register new employee to BIR SSS PhilHealth and Pag-ibig the employer needs to file and remit the taxes and contributions of employee every month. Philippine Labor Code requires an employer to provide for their employees SSS PhilHealth and Pag-IBIG also known as HDMF. Remitted the amount due to SSS and Philhealth and Pag-ibig computed as follows.

The higher you pay the more it will increase the cost of your Pag-IBIG benefits. Both accept payments for Pag-IBIG PhilHealth and SSS contributions. Janice Fabre Tax and Accounting Manager.

I checked lately if my contributions for philhealth pag ibig and sss are updated. OFWs can pay over-the-counter at I-Remit and Ventaja International branches abroad. I havent verified yet with sss.

SSS Pag-IBIG PhilHealth One of the first gateways into our adulting journey is thinking about social security. 20th to 24th day of the month. Pag-IBIG PhilHealth and SSS contribution payments are accepted at all Bayad Center outlets SM bills payment counters and Robinsons Business Centers.

Pag-ibig Home Development Mutual Fund HDMF Payment Deadline. With Triple i Consulting we can assure you that your company will duly comply with SSS PhilHealth and Pag-IBIG. 15th to 19th day of the month.

PHP 200 is the minimum of your monthly contribution. HDMF Pag-ibig Fund Premium. Again it depends on your budget.

PAG-IBIG HDMF EMPLOYER REGISTRATION by amaranthbiz. Assigning a dedicated and experienced Certified Public Accountant to your company we are committed to deliver high-quality assurance services. The guidelines are as follows.

10th to the 14thday of the month. I found out days ago that this bpo did not remit anything for my philhealth and for my pag ibig the last remitted contribution was last Sept 2015. A fine of not less than but not more than twice of the unpaid amount six-year maximum imprisonment or both.

Employers share Employees share SSS 304850 96675 Philhealth 68750 34375 Pag-ibig 95050 65000 Total 468650 196050 October 20 SSS and Philhealth Contributions. 25th to at the end of the month. But as time goes by I realize it is worth knowing if your employer deducts the accurate amount of your SSS Philhealth and HDMFPag-ibig contributions and if they really remit it to your accounts so that you could have the full membership benefits of these government agencies.

R to Z Numeral. I started working with this bpo. First Letter of Employer or Business Name.

Hdmf pag-ibig philhealth phix register remittance sss Posted By. The resulting amount is Php 28688 which falls on the second bracket. SSS Deadline for Employed Sector.

SSS Philhealth and Pag-ibig Penalties for Late Payment. Your withholding tax should be Php 1571 or 20 of Php 28688 after being reduced by Php 20833. October 20 2001 transaction.

Whether youre planning to buy a house preparing for retirement or saving up for insurance its essential to subscribe to different insurance programs to prepare for the future. Failure to pay the contribution on time will cost you to pay interest penalty computed from the due date until the time of payment as follows. All actual remuneration for employment including the mandated cost of living allowance.

Deadlines varies depending on employer number and the government agency but to be safe just remit and submit report before 10 th of the following month. A fine of PHP 5000 to PHP 20000 imprisonment of up to 12 years or both. First you must identify the tax bracket where your salary falls after deducting SSS Pag-ibig and PhilHealth contribution.

Please take note of the new due dates for remittance of contributions. PhilHealth and Home Development Mutual Fund HDMF.

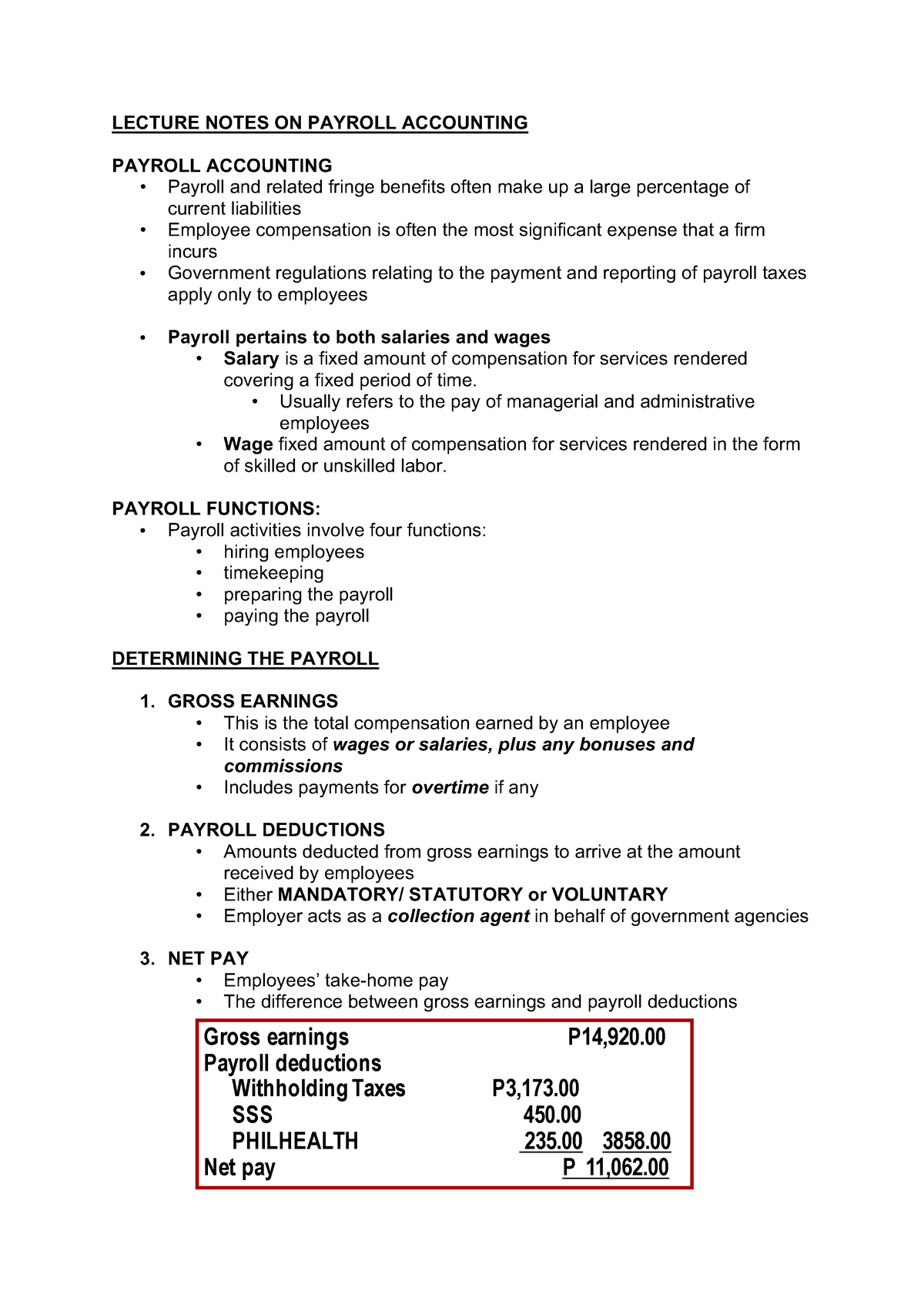

Payroll Notes Basic Accounting Studocu

Komentar