You can also claim for provident benefits. If the valid IDs do not reflect the date.

Pag Ibig Lump Sum How To Claim Pag Ibig Contributions Coins Ph

Employees from establishments regularly employing not more than 10 employees.

Retirement benefits in pag ibig. If your area has been devastated by a calamity such as a typhoon or a landslide you can avail of Pag-IBIGs Calamity Loan. You can withdraw your Pag-IBIG regular savings if any of the following occurs. Create an account using your email or sign in via Google or Facebook.

It expects its members to consolidate their records. GSIS Retirement Voucher For government employees 1. Confirm with your employer if they have a separate retirement pay for employees.

Pag-ibig does not consolidate the records of members whose employers are located in different Pag-ibig jurisdictions. If you plan to retire early take note that you need to be at least 45 years old to make retirement Pag-IBIG claims. The Department of Labor and Employment has called on employers anew for the full provision of benefits to their workers by way of compulsory enrollment and remittance to the SSS Philhealth and Pagibig.

Retirement Benefits from Pag ibig Philippine Socialized HousingFOR MORE INFO ABOUT PAG IBIG FUNDhttpwwwpagibigfundgovphABOUT HDMFhttpwwwpagibigf. As a contributing member you can get your Pag-IBIG savings upon retirement at age 60 optional or 65 mandatory. If youre nearing retirement and youve had more than one employer check as soon as you can if all the records of your contributions since your started contributing to Pag-ibig are already in one branch of Pag-ibig.

What is Provident Savings. Short Term Loan Just like SSS and GSIS Pag-IBIG Fund also offers financial assistance to qualified member by granting short term loan. It takes months to consolidate so start now.

You can earn more dividends by increasing your monthly Pag-IBIG contribution. You may retire earlier at age 60 from the SSS GSIS or government service or under your private employers retirement. At the end of your membership you can refund your total accumulated value TAV.

Pag-IBIG Fund members who have reached 65 years of age can fully claim their monthly contributions employers counterparts and earned dividends. Pag-IBIG Provident Benefits. The move was prompted by numerous complaints of non-compliance by employers in past months.

The best part is the sum of your contributions and dividends will have grown much more than the same amount stored in the bank even with interest. Additionally the employer may opt to substitute the retirement pay benefit for the Pag-IBIG Fund as long as they regularly shared in the employees contributions. Know More About Pag ibig BenefitsFor More InfohttpwwwpagibigfundgovphFREQUENTLY ASKED QUESTIONShttpwwwpagibigfundgovphfaqaspx.

Open it up with online editor and start altering. Install the signNow application on your iOS device. Requirements for Claiming Your Pag-ibig Retirement Benefits.

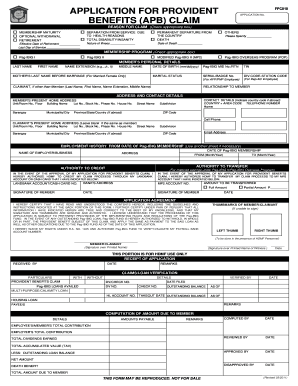

Unlike your voluntary savings in a bank savings and contributions to the Pag-IBIG fund guarantee tax-exempted annual dividends. To sign a pag ibig retirement form right from your iPhone or iPad just follow these brief guidelines. Application for Provident Benefits APB Claim Form You can download this form from this Pag-ibig Funds Google Docs.

The interest rate is at a low 595 per annum and youre also given a grace period of 3 months before you need to start paying. Upload the PDF you need to e-sign. In this post we will discuss about provident savings that most people dont know.

Involved parties names addresses and numbers etc. If Pag-IBIG Loyalty Card is not available two 2 valid IDs present original and submit photocopy. Unlike banks the fact that Pag-IBIG.

Change the blanks with unique fillable areas. Application for Provident Benefits APB Claim Form HQP-PFF-285 CHECKLIST OF REQUIREMENTS. Photocopy of Pag-ibig Loyalty Card and photocopy of one.

Provident Benefits Claim Checklist of Requirements. There is a Calamity Loan for members affected by unforeseen calamity like flood fire volcanic eruption and other similar cases. Basically there are three programsbenefits that every qualified member should know such as short-term loan housing loan and provident savings.

Include the particular date and place your e-signature. Certificate of Early Retirement For private employees who are at least 45 years old Notarized 1 Photocopy 4. Click Done following double-checking everything.

This service financially assists retired and Filipino senior citizens who deserve to enjoy the fruits of their years of hard work. Complete the empty areas. For retirement purposes the valid IDs must reflect the members date of birth.

SPECIFIC REQUIREMENTS FOR RETIREES NSO birth certificate SSS or GSIS Retirement Voucher or two valid IDs with photo signature and birthdate. Application for Provident Benefits APB Claim 1 Original 2. Membership maturity after 20 years or 240 months of contribution Retirement at 60 years old optional or 65 years old mandatory.

Ipunin mo ang records mo sa isang Pag-ibig. When you reach 65 years old youll be under compulsory retirement and thus eligible to claim your Pag-IBIG contributions. Pag-IBIG Loyalty Card Plus or one 1 valid ID of the member 1 Photocopy 3.

This short-term loan provides a lump sum equivalent to up to 80 of your total accumulated value TAV. PAG-IBIG Fund offers various programs and benefits to its members. Here are a few benefits you enjoy as a Pag-IBIG fund member.

Get the Pag Ibig Retirement Form you need.

Pag Ibig Retirement Claim Online Application Fill Online Printable Fillable Blank Pdffiller

Komentar