As discussed in the previous question the fixed pricing period is one of the three factors that determine the amount of your monthly amortization ie payment for the housing loan. The fixed pricing period is how long you want to lock-in the interest rate of your loan.

What Is A Fixed Pricing Period In Pag Ibig Housing Loan

Using a Loan Calculator.

Preferred fixed pricing period pag ibig meaning. Fixed Pricing Period in PAGIBIG Housing Loan. This means the interest rate will not change or wont be repriced within the duration of the lock-in period. The fixed pricing period is somehow you are locking-in the interest rate to that year.

Pricing Period 1 year. Pricing Period 1 year. This is a cash or salary loan offered by Pag-IBIG to its members who have religiously settled their monthly premiums for 24 straight months.

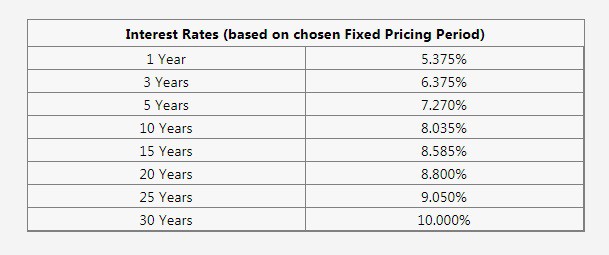

The proposed pricing framework would adopt the following. Repricing period also referred to as cycle tenor or fixing period is the period for which the interest indicated will apply. Pag-IBIG housing loans shall be charged with interest rates based on the Funds pricing framework.

After this period interest rates will be repriced to either go up or down depending on economic factors prevailing at the time of repricing. The Pag-IBIG housing loan calculator is also useful if you want to know the required gross monthly income for the amount you want to borrow. Interest rates may be fixed for 3 5 10 or 15 years.

What is Pag-IBIG MP2. For example if you want a 3-year fixed pricing period your PAGIBIG housing loan will have an interest. Table of Contents.

Nagmumula ang kalituhan dahil tulad ng loan term ang fixing period ay. Said interest rates shall be re-priced periodically depending on the chosen fixed pricing period of the borrower. The Modified Pag-IBIG II better known as MP2 is an optional savings program for current and former Pag-IBIG Fund members who want to grow their savings in addition to their Pag-IBIG regular savings.

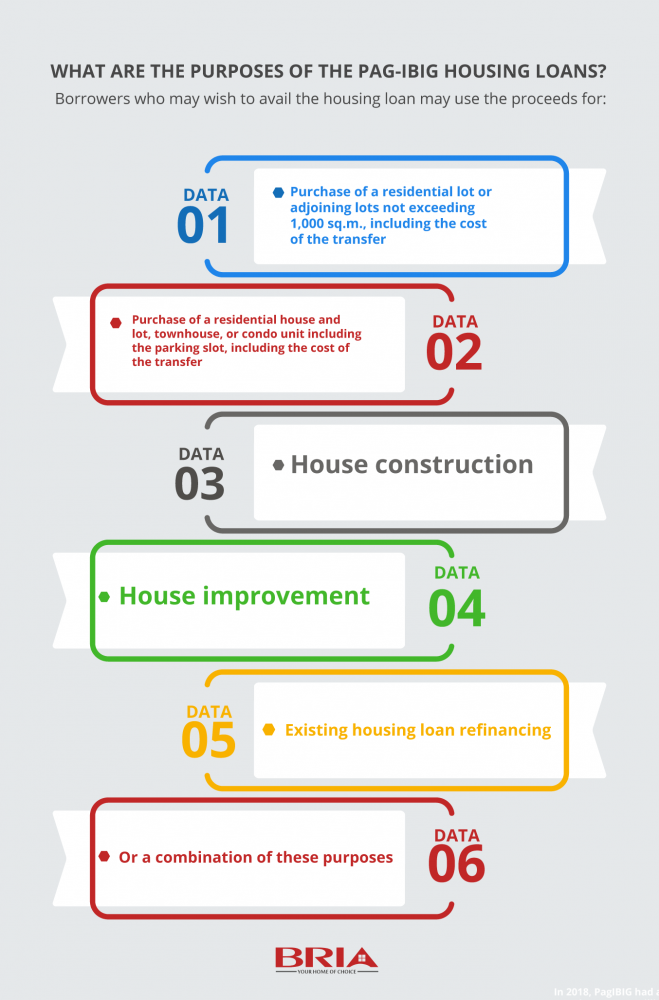

The loan amount is the amount of housing loan you can borrow that has been approved by Pag IBIG. The maximum repayment period for the loan is thirty 30 years. 211 JUNE 21 - JUNE 25 2021 NCR BRANCH - SPB 177 1st Auction - no discount Batangas Bulacan Cavite Laguna Rizal and Metro Manila.

Fixing period naman ang tawag sa tagal ng panahon na ipapataw ang interest rate sa iyong loan. Said interest rates shall be re-priced periodically depending on the chosen re-pricing period of the borrower whether it is after every three 3 five 5 ten 10 or fifteen 15 years. 212 JUNE 28 - JULY 02 2021 CEBU HOUSING HUB - SPB 66th 1st Auction - No Discount CEBU PROPERTIES.

2 Pag-IBIG Acquired Assets For Sale June 2021. Members can borrow up to 80 of their Pag-IBIG Regular Savings and it can be paid up to 24 months. How long is the repayment term.

Pag-IBIG MP2 Key Features. What You Need to Know. If your terms of payment are 10 years and you choose interest rate for 10 years it means you are locking-in your loan to have the same interest rate for the whole duration of your loan.

Loan Amount Indicative Rates per Re-Pricing Period 3-yr 5-yr 10-yr 15-yr Up to P6M 7985 8985 10 1075 Loan Amount Indicative Rates per Re-Pricing Period 20-yr 25-yr 30-yr Up to P6M 11125 1150 1225 19. Interest Rate for Houses bought from Developers. Loan period or loan repayment period on the other hand is the number of years that youll be paying for the monthly amortization.

The pricing period also known as the repricing period determines the interest rate that Pag-IBIG will charge you. Special Power of Attorney For Conversion to Full Risk-Based Program changed in Fixed Pricing Period and Loan Term Adjustment HQP-HLF-318. You only need to fill out the needed information such as your gross monthly income preferred repayment period up to 30 years and preferred fixed pricing period.

Also known as the repricing period tenor cycle or fixing period it refers to the time frame during which the fixed interest rate will apply. MP2 makes saving and investing money easy affordable and quite profitable for Filipinos. This cash loan program extends cash loan assistance to members for any type of financial needs.

What is fixed pricing period in PAGIBIGs housing loan. The calculation is based on your income your chosen loan term and fixed pricing period and the estimated value of the property you want to buy. Preferred Fixed Pricing Period.

21 For Public Auction. Tinatawag din itong repricing period cycle o tenor. Checklist of Requirements for Changed in Fixed Pricing Period.

When the new rates take effect on July 1 Pag-IBIG Funds End-User Financing Program will come with rates of 5500 for a 1-year fixed-pricing period 6500 for 3 years 7270 for 5 years 8035 for 10 years 8585 for 15 years 8800 for 20 years 9050 for 25 years and 10000 under a 30-year fixed-pricing period. Sa ngayon ito ay isa hanggang 30 taon. Your preferred fixed pricing period.

The base rate for succeeding re-pricing shall be the interest rate for the immediately preceding re-pricing period. Preferred Fixed Pricing Period.

Pag Ibig Housing Loan A Comprehensive Guide On How To Avail Bria Homes

Komentar